Dear Friends,

Before I skip to the data, I’d like to take a brief moment to offer my thanks to you, my wonderful friends and clients, for the precious trust you place in me year after year and the joy you bring to my each and every day. I feel so deeply honored to have been ranked #17 in the entire state of New York and #117 across the country for my sales volume as an individual agent in 2023, earning me a spot among Real Trend's THE THOUSAND, a verified ranking of the top real estate professionals in America. It is all of you whom I thank, so very much.

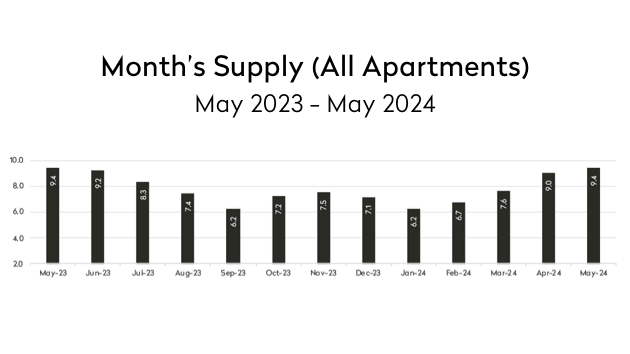

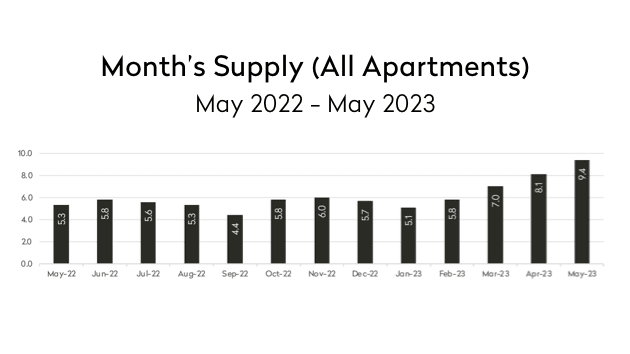

May’s supply rate came in at 9.4 months, up 5% from April when it was 9.0 months and very much in line with the gradual monthly increase in supply we typically see beginning in January as new listings enter the market for the Spring.

While beyond what is traditionally considered a balanced market (a supply rate of 6-7 months), May’s supply rate was the same as it was last year but well above that of May 2022 when the supply rate was 5.3 months.

While a part of this relatively high supply rate is a factor of seasonal trends in our market as noted above, the sustained high cost of financing continues to impact the rate at which property is trading.

At a glance

- All neighborhoods posted an increase in supply in May, but the West Side was the tightest market at 7.0 months.

- Midtown West was the most oversupplied market with a supply rate of 12.2 months.

- Overall, 3+ bedroom condos topped the charts with a supply rate of 16.0 months, followed by 3+ bedroom co-ops with a supply rate of 12.6 months.

Condos posted a supply rate of 11.3 months in May, unchanged from April but up from May 2023 when the supply rate was 10 months. There were 3,761 condos on the market in May, up 10% from April when there were 3,415 but only about 0.8% up from May 2023 when there were 3,730 condo listings. The notable increase in supply rate between May 2024 and May 2023 and marginal increase in inventory suggests a market that is absorbing condos more slowly this year than last.

Co-ops posted a supply rate of 8.1 months in May, up from April when the supply rate was 7.3 months but slightly down from May 2023 when the supply rate was 8.8 months. There were 3,632 co-ops on the market in May, up 14% from April when there were 3,185 but down 4% from May 2023 when there were 3,796 co-op listings.

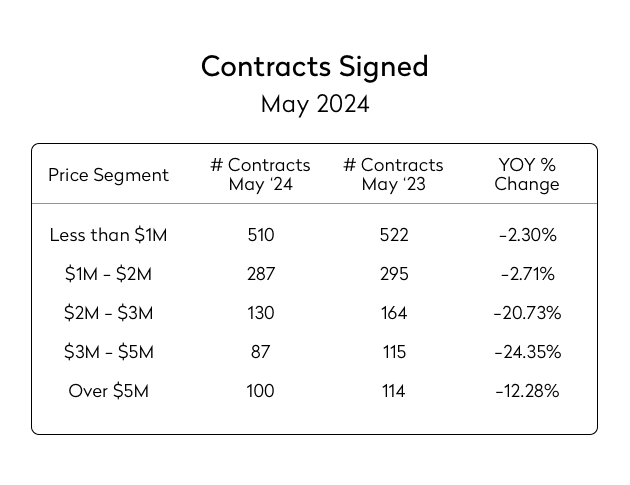

By the end of May, we saw signed contract activity pull back significantly year-over-year for property priced $2M to $5M. There were 24% fewer contracts signed in May on property asking $3M to $5M this year compared to last, and 21% fewer contracts signed for those asking $2M to $3M. By contrast, the under $1M segment of the market only slipped about 2% in May year-over-year.

While contract signings for properties asking $5M+ were down about 12% year-over-year by the end of May, we saw a significant number of signed contracts on properties asking over $10M.

According to data from the Olshan Report which monitors the upper end of the luxury market, there were 39 contracts signed on properties asking $10M+ which is about 34% of those signed asking over $5M – no small number. As those purchasing over $5M start to typically be buying all cash, they are often not dissuaded by the cost of financing and are instead seizing opportunity in a soft market.

Most buyers now in the market are seeing opportunity they wish to seize and/or cannot delay a purchase due to lifecycle events. I expect that to slow down a bit in the Fall – elections typically slow markets down – and resume with probable increase should interest rates in fact soften in early 2025.

As for sellers, when they hold lower rate mortgages on their current homes and can avoid an immediate move they do so as they neither wish to take a hit in a slow market nor trade a 3% mortgage for a 7% one; they’re hoping 2025 will be kinder to them, and I believe it will. Sellers who cannot avoid an immediate sale have to meet the market or languish on it, many of them having to incur a loss over how much they paid, even sometimes on purchases dating back to 2007.

Overall, both buyers and sellers do want to trade, and I anticipate volume increases in early 2025 as a result. For example, when news of interest rates coming down broke at the start of April, we saw an immediate jump in the number of buyers out shopping. That then slowed with subsequent headlines to the contrary, but the momentary immediate jump was remarkable. Now as we get into the thick of election season, I expect increased buyer hesitation as noted above, but that leaves an excellent window of opportunity for buyers to take advantage of broad market hesitation in advance of increased stability and likely less opportunity in 2025.

If history and 23 years of experience have taught me anything it’s that periods of modest activity are often followed by a frenzy, and as referenced here throughout I do expect that as we push past the presidential election and people either make greater peace with current interest rates or see them soften, that activity will increase and perhaps prices albeit slowly, too.

I so hope the above was useful to you, and please never hesitate to reach out to me anytime for more information or any real estate wants or needs you may have.

All my best,

Daniella