Dear Friends,

I hope this email finds you all well and enjoying the Fall!

As many of you have likely been reading, the market has been seeing some dramatic movement over the past year and particularly so in recent months. As we approach the last few months of the year at this extremely dynamic time, Brown Harris Stevens has just issued its Third Quarter Manhattan Residential Market Report for 2022, offering an in-depth look at residential sales trends in Manhattan for the past quarter.

While we continue to see evidence of the market’s slowdown in this report, we also see that half of the closings in the third quarter of 2022 had their contracts signed before May 18, which is around when the market began to shift as I referenced in my last report to you rendering that data somewhat misleading. To paint a more current picture of where the market is now, I’ve contextualized and supplemented my analysis below by drawing from Brown Harris Stevens’ Contract Signed and October Inventory Reports as well as the current contract signed numbers for the Upper Luxury segment of the market ($4M+) which I closely monitor. It is my hope that you will find this assembly of data points and ensuing analyses useful in what I believe is a market moment in which only the most up-to-date analysis serves you in seizing what is likely limited opportunity, both on the buy side and the sell side.

In your review of the below, should you wish to receive any of the reports here referenced in their entirety, would like any further detail on the information here enclosed or have any needs or questions for which I can be of service, please don’t hesitate to call.

With all my gratitude and best wishes,

The Overall Market

The average Manhattan apartment sales price rose 2% to $1,954,760 from a year ago when it was $1,910,259 but dropped 8% from Q2 2022 when it was $2,117,550. This quarter, the average sales price was pulled up by strong new development sales which came in at an average of $3,835,100 compared to $3,116,077 a year ago. The average sales price in resale dropped to $1,624,945 in Q3, down 4% from a year ago when it was $1,693,375 and 6.5% lower than Q2 2022 when it was $1,738,878 and was undoubtedly influenced by the economic woes which came with news of record stock market losses, rising inflation and interest rate hikes. I expect that we’ll see the full impact of these shifts in our next report for Q4 where the majority of closings will have had contracts signed in the aftermath of those changes.

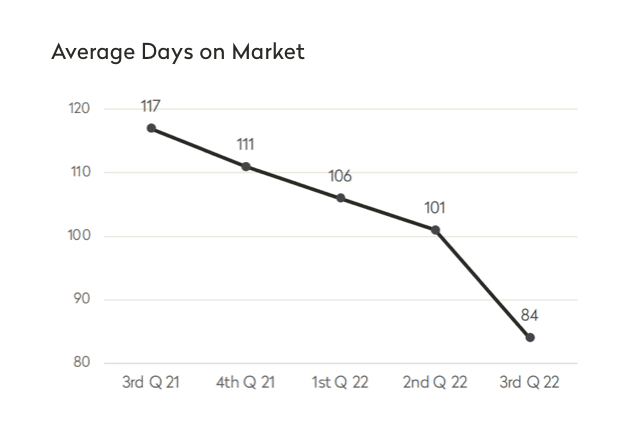

That all said, the average time on market for resale apartments dropped substantially to 84 days in Q3 2022, a significant improvement over the 101 days in Q2 2022 and 117 days a year ago. Resale apartments in Q3 this year achieved 98.5% of their last asking prices, up substantially from 97.4% a year ago. I believe both these data points to reflect both currently lean inventory and that seller price expectations were much more in sync with what buyers were willing to pay this year than they were last year.

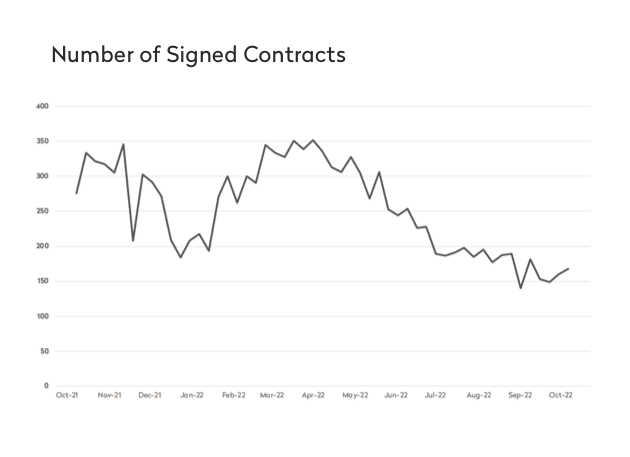

For those of you considering selling, inventory remains relatively lean and quality property continues to trade well. We’ve seen a rise in deal activity since the end of the Jewish holidays with signed contracts up 5% last week to their highest levels in a month – it’s something I’m seeing not only in our reports but firsthand in my own business as buyers have started to reemerge. According to the data, the West Side is garnering the majority of the interest and experienced an 86% surge in deals from last week with 39 signed contracts compared to 21 for the week prior.

For those of you who have been putting off buying, it’s my opinion that now is the time to jump in. Activity is on the upswing but it’s still not a competitive market – it remains an uncertain one in which opportunities for buyers willing to pull the trigger and sellers willing to meet the market before their competitors do always present. While the Spring may not bring a vastly stronger market or lower interest rates, I do expect that people on both sides of the market will soon be unable to put off life-cycle-motivated transactions any longer and will settle into a new normal, as they always do. As we approach the Spring market, buyers will likely have made peace with current interest rates somewhat balanced by asking prices, and sellers will have more competition as those who chosen to wait to sell in the Spring will wait no longer. I see a moment now which offers opportunity I expect us to identify only once it’s in our rear-view mirror. And I just went into contract to buy a vacation house for myself accordingly 😊

Upper Luxury: $4M+

Last week there were 24 contracts signed for listings with asking prices over $4M, the strongest week for the Upper Luxury segment of the market since the week of July 25 when there were also 24 contracts signed. This rise coincides with the overall market which as noted above experienced a 5% jump and also represents a dramatic improvement from the tempo we’d been observing for most of September when there were an average of 15 contracts signed per week on listings asking over $4M. Volume totaled at $198,295,000 which was the highest figure since the week of June 27 when it was $203,225,000. That said, the average discount from original asking price to last asking in the last 4 weeks is 12.5% compared to 7% for the 4 weeks prior (8/22 – 9/18), suggesting both that only when sellers meet the market do their properties trade, and that asking prices seemingly still have to come down a bit to land there.

Inventory

Resuming the seasonal cadence that characterized our market before the pandemic, inventory jumped 30% in October after shrinking for 3 consecutive months. That said, we still remain lean in supply with an absorption rate of 5.8 months (a market is considered balanced at 6-7 months) which is good news for the savvy seller. While the market has cooled since last year, there are buyers in the wings ready to swoop in when the price feels right! I’m still seeing good product fly into contract if priced properly – just this week I saw a gorgeous 2-bedroom at the Greenwich Lane go into contract within 7 days asking $5.5M.

A few highlights for you:

- Coops are in shorter supply than coops: the absorption rate for coops in October is 5.3 compared to 6.3 for condos.

- Supply is lowest Downtown between 14th and 34th Street at 4.7 months followed by the West Side at 4.8 months.

- The most oversupplied neighborhood is again Midtown West at 9 months, up from 8.2 months in September.

Summary

In summary, while it’s undeniable that the market has slowed down in the face of economic strain after what was a record-setting time, there are still excellent signs of momentum and certainly ample opportunity for anyone prepared to dive in. The pundits are divided on whether or not we are approaching a recession, but none are predicting a dramatic drop in real estate values in Manhattan so what I expect as noted above is that by Spring the climate will have shifted to one that’s more stable. Consumers’ Covid relief funds will run out and interest rates can level as a result, and the straightforward traditional seasonal demand will be amplified by a pent-up buyer pool re-entering the market after a hiatus. At that time, I do expect us to see a more competitive market for buyers and stabilized, softer pricing and more competition for sellers as the data comes in for properties with contracts signed after May reflecting sale prices which have manifested the increased cost of borrowing and sluggish demand over the last 5 months. Again, I do believe that we are at a key juncture now where the opportunity for the savvy on both sides is very much real.

I so hope the above feedback has been useful to you, and please don’t hesitate to get in touch with questions or requests for copies of any of the reports referenced in this analysis. As you consider your needs, be they immediate or for continued information, I hope that you will continue to think of me as your expert and that you won’t hesitate to reach out to me with any real estate needs that you may have.

Warmly,