Dear Friends,

The Overall Market

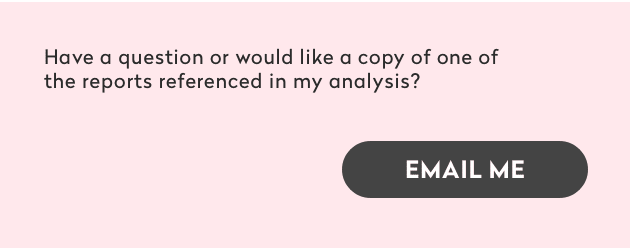

For Manhattan apartments, the average sales price was $1,998,926 in Q3 2023, up a little over 1% from a year ago when it was $1,973,390. The median sales price dipped 1% to $1,160,000 in Q3 2023 from last year when it was $1,175,000.

For Manhattan apartments, the average sales price was $1,998,926 in Q3 2023, up a little over 1% from a year ago when it was $1,973,390. The median sales price dipped 1% to $1,160,000 in Q3 2023 from last year when it was $1,175,000.

In New Development, the average sale price was $2,979,503 in Q3 2023, down about 22% from last year when it was $3,823,599 as fewer high-ticket apartments traded. The average price per square foot by comparison only fell about 5% to $2,020 from last year when it was $2,137.

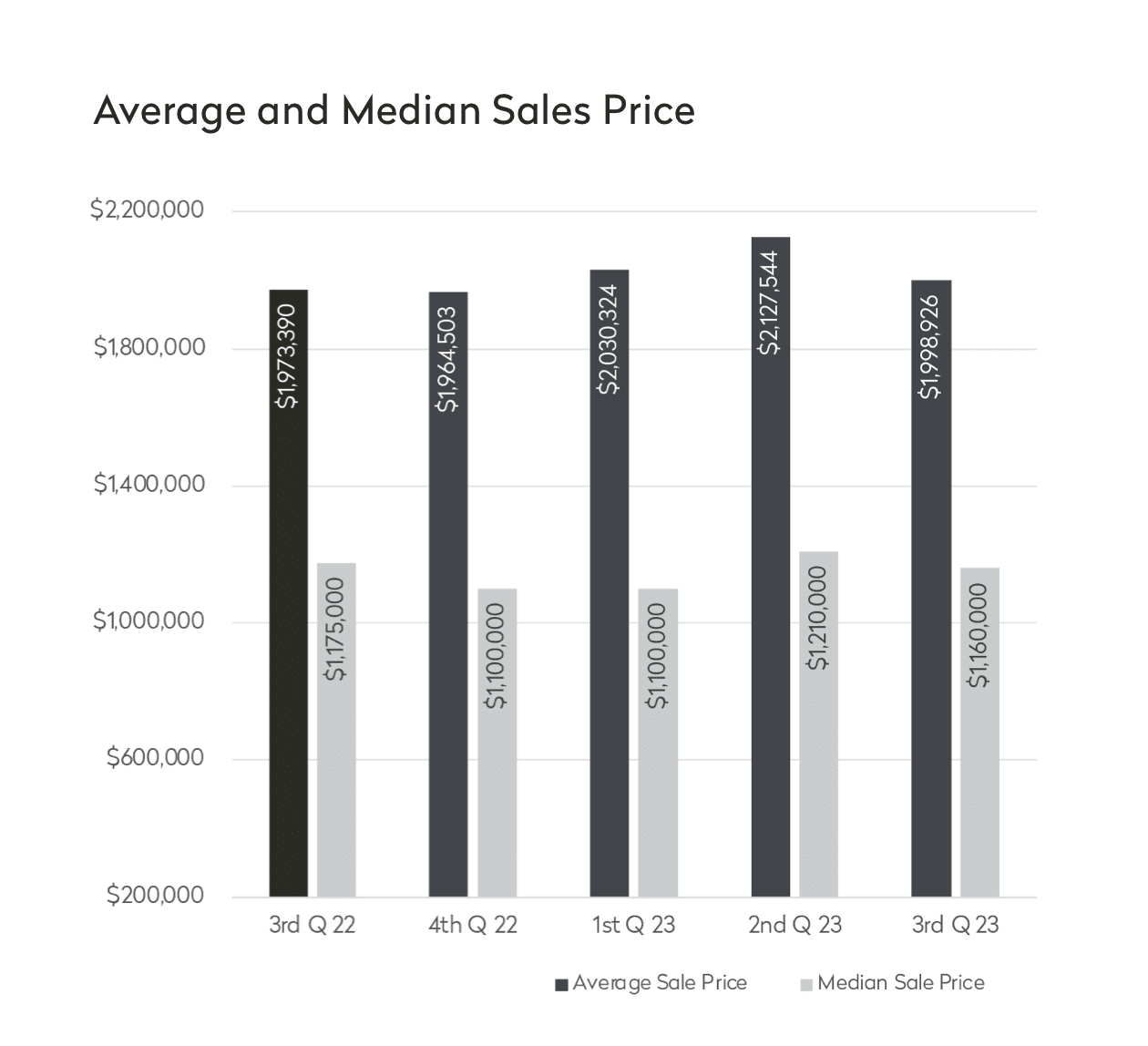

Resale had a much stronger quarter as prices averaged 9% higher than last year, up to $1,760,380 from $1,621,996. The median price was $1,050,000 in Q3 2023, crossing the $1M mark for the first time since Q2 2022 when it was also $1,050,000.

While resale co-ops saw marginal declines, resale condo average sales prices surged 13% to $2,422,727 in Q3 2023 from $2,149,682 last year. Leading the gains, 3+ bedroom condos saw their prices increase 21% to $5,927,276 from $4,882,098.

Upper Luxury: $4M+

Upper Luxury: $4M+

As for the Upper Luxury segment of the market, we are seeing slightly fewer contracts for apartments listed at $4M+ now than we saw last year at this time. While sales data is a lagging indicator, data on contract signings offer us a real-time snapshot into the health of the market right now.

Since Labor Day, 117 contracts were signed in the Upper Luxury segment of the market compared to 126 for the same period last year. While contract signing activity in the Upper Luxury segment has pulled back year over year, this modest dip in activity is encouraging in light of rising interest rates. Serious cash-buyers are shopping now and pulling triggers – I have seen competitive bidding on rare high-ticket property as buyers who have been on the sidelines wait for new listings to hit the market.

Inventory

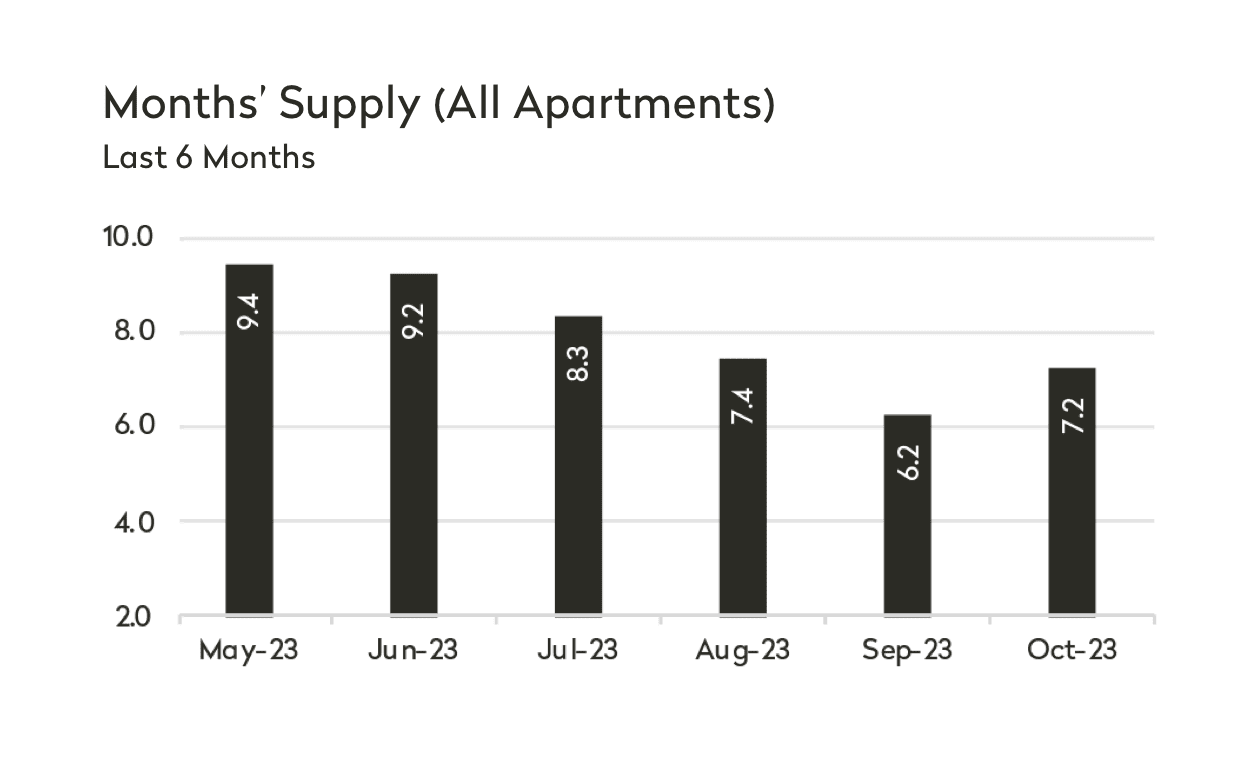

Inventory is one of the best indicators for the health of the market. The Brown Harris Stevens’ October Inventory Report shows an increase in the supply rate for the first time since May. October's supply rate was 7.2 months, representing a 16% increase in supply.

Since last month, inventory for condos climbed 14% and inventory for co-ops climbed 28%. Despite these increases, co-ops remain in slightly tighter supply than condos.

A few highlights for you:

- On the whole, co-ops have a supply rate of 6.7 months whereas condos have a supply rate of 7.8 months.

- Supply was lowest on the West Side at 6.1 months.

The most oversupplied neighborhood was again Midtown West at 9.9 months.

A healthy relationship between supply and demand has kept Manhattan prices very stable compared to the rest of the nation where we’ve seen prices move in big ways. The increased cost of financing in recent months has drastically decreased the amount of purchasing power buyers once had, thereby impacting buyer activity. On the flip side, homeowners aren’t listing, and inventory is tight. Prices aren’t meaningfully softening, and there is no indication on the horizon that they will.

For those purchasing cash or needing to make a life-cycle motivated move, this should be your cue – competition is low now while so many wait for rates to come down and their purchasing power to increase. Demand is bottled, not gone. Once we see rates begin to drop, we’ll see that pent-up demand break free like we did in the wake of the pandemic. Competition will drive prices up, and buyers will lose the purchase power they’d hoped to gain with better rates.

For sellers, these high mortgage rates mean that buyers have never been more serious – I’m witnessing it. Buyers are snatching up quality property that is priced to the market, and tight inventory means fewer competing listings. Co-ops are particularly undersupplied, and condos are in unusually high demand.

Summary

In conclusion, it is important to keep in mind that our market is a resilient one, with its own unique dynamics and nuances. Prices have remained stable over the last quarter, a phenomenon likely to continue with no significant mortgage rate declines or supply injections on the horizon. For buyers, those needing to make a life-cycle motivated purchase or buying in cash have a unique opportunity to capitalize on lower levels of competition. For those considering selling, prices are well supported and buyers are waiting for property in tight supply, increasing the odds of locking in strong sale prices when priced to the market. Whatever your needs may be, our current market is the product of a rare intersection of factors making it ripe with opportunity for savvy people on all sides with clear goals and seasoned representation.

I so hope the above feedback has been useful to you, and please don’t hesitate to get in touch with questions or requests for copies of any of the reports referenced in this analysis. As you consider your needs, be they immediate or for continued information, I hope that you will continue to think of me as your expert and that you won’t hesitate to reach out to me with any real estate needs that you may have.

Warmly,