Dear Friends,

Happy Monday, and I hope this email finds you all well and enjoying the start of a fresh, new and promising year!

With all my best wishes,

The Overall Market

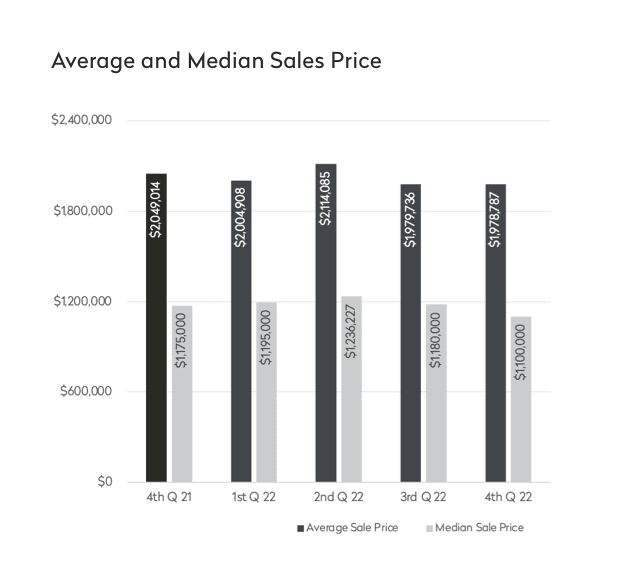

The average Manhattan apartment sales price was $1,978,787 in Q4 2022 which is virtually unchanged from the prior quarter when it was $1,987,736. The average apartment sales price declined approximately 3% from the same time last year when it was $2,049,014.

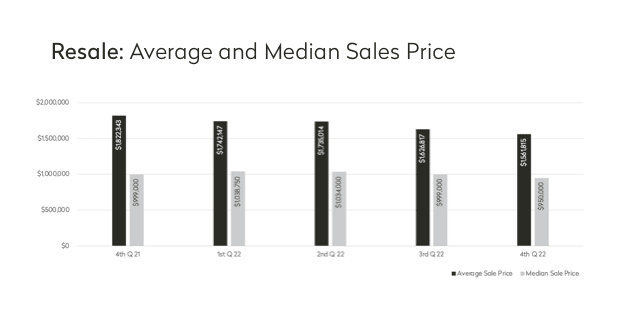

Here it’s important to note that the average sales prices for Manhattan were in great part supported by strong New Development sales which on average saw an 11% rise from $3,257,477 in Q4 2021 to $3,626,070 in Q4 2022. This uptick in high-end New Development closings helped balance the softening in resale figures which averaged $1,561,815 in Q4 2022 compared to $1,822,343 for the same period a year ago, a 14% drop illustrating the impact that economic conditions and interest rates have had on property values. Resale co-ops only dropped 5% from last year whereas resale condos fell about 19% overall as fewer high-ticket resale 3+ bedroom condo averages dropped to $4,772,983 in Q4 2022 from $6,808,444 in Q4 2021.

As for activity, there were 35% fewer closings in Q4 2022 at 2,738 compared to 4,242 in Q4 2021 which as mentioned represents the surge in activity that characterized the end of 2021 and start of 2022. While 2023 has started off well with a 13% rise in contract activity between the last week of 2022 and first week of 2023, the same period one year ago was about 40% stronger.

Upper Luxury: $4M+

Mirroring what we saw throughout the market, the second half of 2022 saw 507 contracts signed which accounted for only approximately 38% of the total deals in 2022 during which there were 1,343 contracts signed on apartments $4M and up according to year-end data from the Olshan Report which covers activity in this price range. Here too the data must be viewed in context with historic market performance as 2020 saw very little activity due to the pandemic with only 645 contracts and 2021 brought unprecedented highs with 1,919 contracts signed resulting from pent-up buyer demand, a strong stock market and very attractive financing options. Zooming out and looking at the past decade, we find that 2022 saw more deal activity in this segment of the market than 2016 – 2019 during which time there was an average of 1,079 contracts signed per year. Instead activity in 2022 resembled that of 2013 – 2015 when contract signings ranged tightly between 1,340 – 1,372.

Inventory

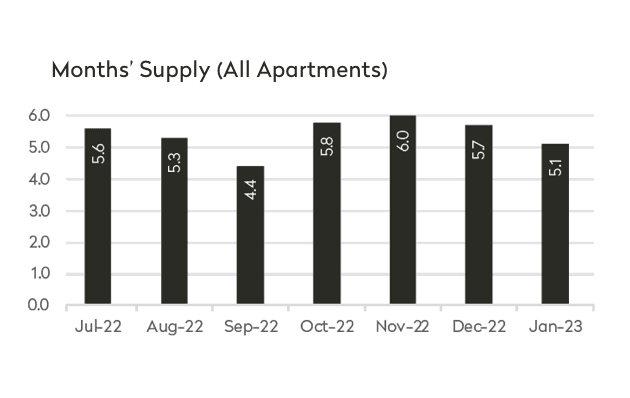

Inventory contracted as we transitioned into the new year as it often does – January saw a 9% decrease in the supply rate which came in at 5.1 months which though higher than the same time last year when inventory was very lean at 3.9 months remains below what is generally considered a balanced market with a supply rate of between 6 – 7 months.

- Overall, 3+ bedroom condos were the most abundant property type with a supply rate of 9.3 months.

- The East Side had a supply rate of 5.6 months.

- Supply was lowest on the West Side at 4.0 months, a significant decrease from December when the supply rate was 4.7 months.

- Midtown East and Midtown West tied for the most oversupplied with supply rates of 6.9 months. In December, Midtown West recorded a supply rate of 8.1 months and Midtown East recorded a supply rate of 7.5 months.

Summary

In conclusion, while the waters seem calmer for the time being, I do foresee activity picking up as we approach the Spring market and buyers are no longer able to continue to table life-cycle motivated moves and gain greater comfort with new financing norms. I am already seeing excellent signs of life in just the first few weeks of the new year with a notably increased rate of showing requests for a number of my active listings and buyers reaching out to me to view property. The coming weeks will be crucial as we gain a grip on the pulse of the market, but there is undoubtedly ample opportunity on both sides with the fresh enthusiasm a new year brings.

I so hope the above feedback has been useful to you, and please don’t hesitate to get in touch with questions or requests for copies of any of the reports referenced in this analysis. As you consider your needs, be they immediate or for continued information, I hope that you will continue to think of me as your expert and that you won’t hesitate to reach out to me with any real estate needs that you may have.