Dear Friends,

I hope that this message finds you all well and enjoying the start of a brand new year!

Brown Harris Stevens has issued its Fourth Quarter Manhattan Residential Market Report for 2023, offering an in-depth look at residential sales trends in Manhattan for the past quarter.

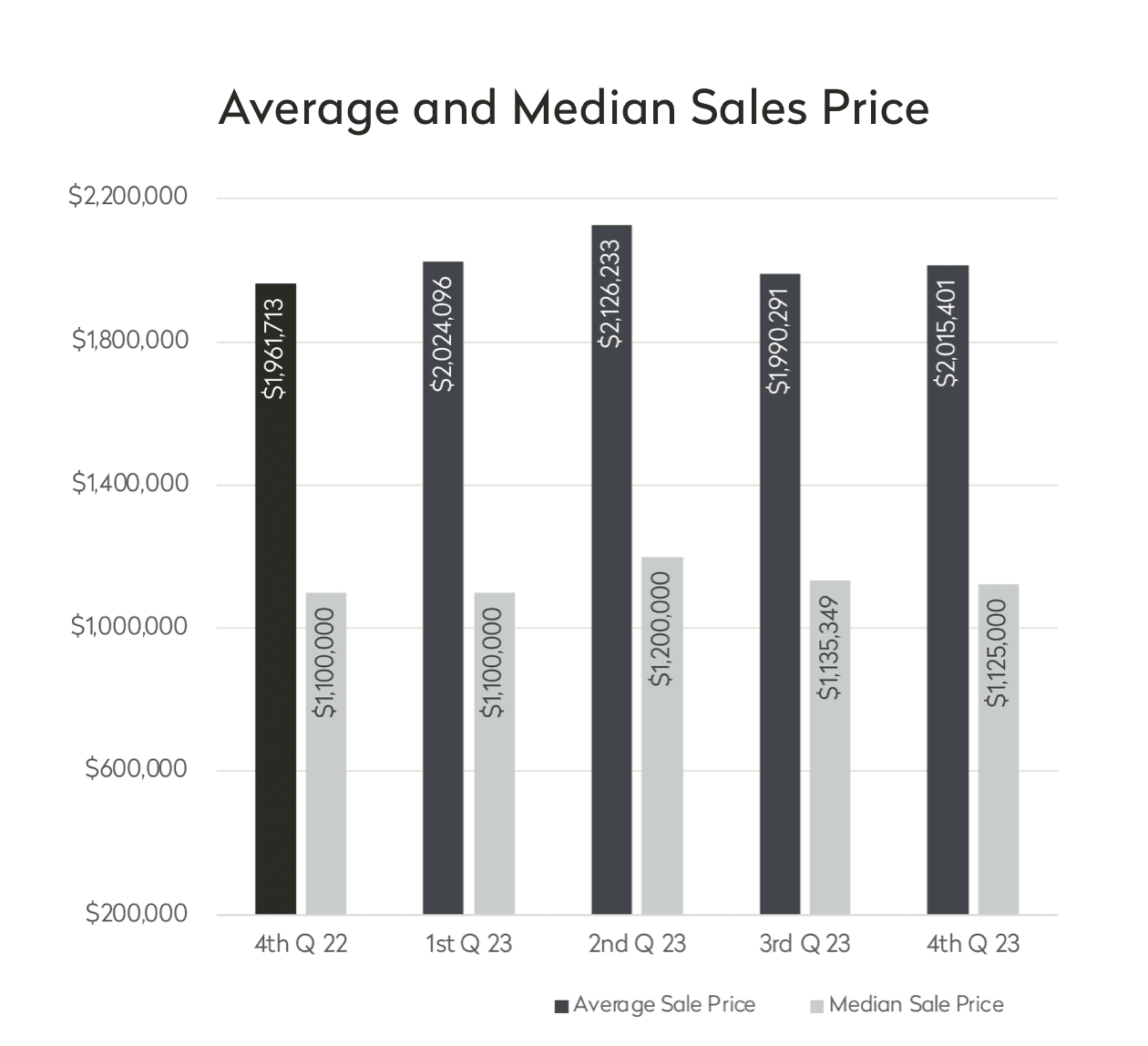

As expected, high mortgage rates continued to have an impact on the Manhattan apartment market, but despite rates hitting a 23-year high in October 2023, there were 2,715 closings in Q4 2023 which represents just a 2% dip from Q4 2022 when there were 2,776 closings. The overall slowdown in activity due to interest rates and economic factors is, however, more apparent in the annual totals which show a 27% drop in the number of closings in 2023 when there were 11,228 closings and 2022 when there were 15,423. We are likely to see this sluggishness again expressed in our Q1 2024 report as contract activity slowed at the end of 2023, so far remaining low as lean inventory continues to support prices to some degree.

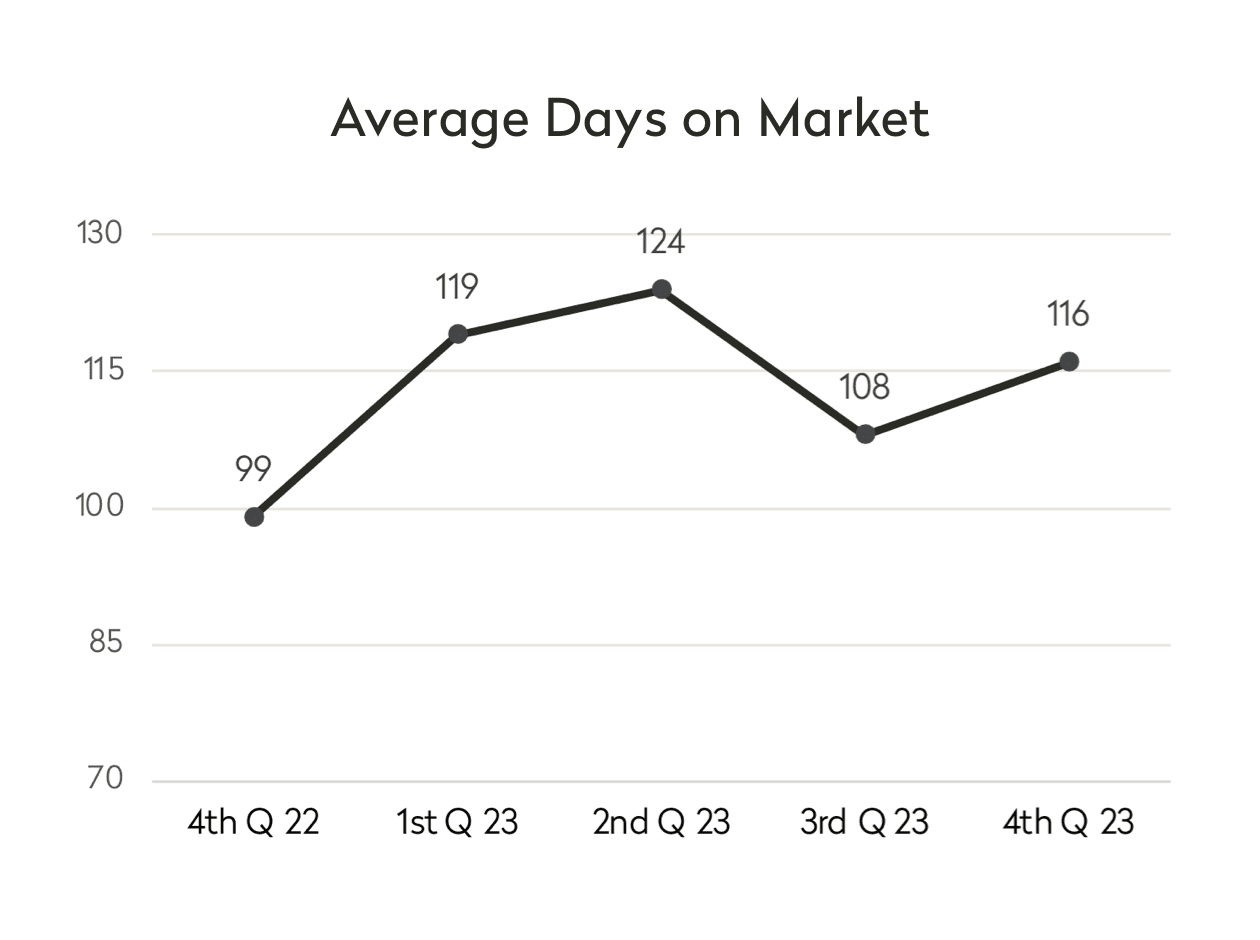

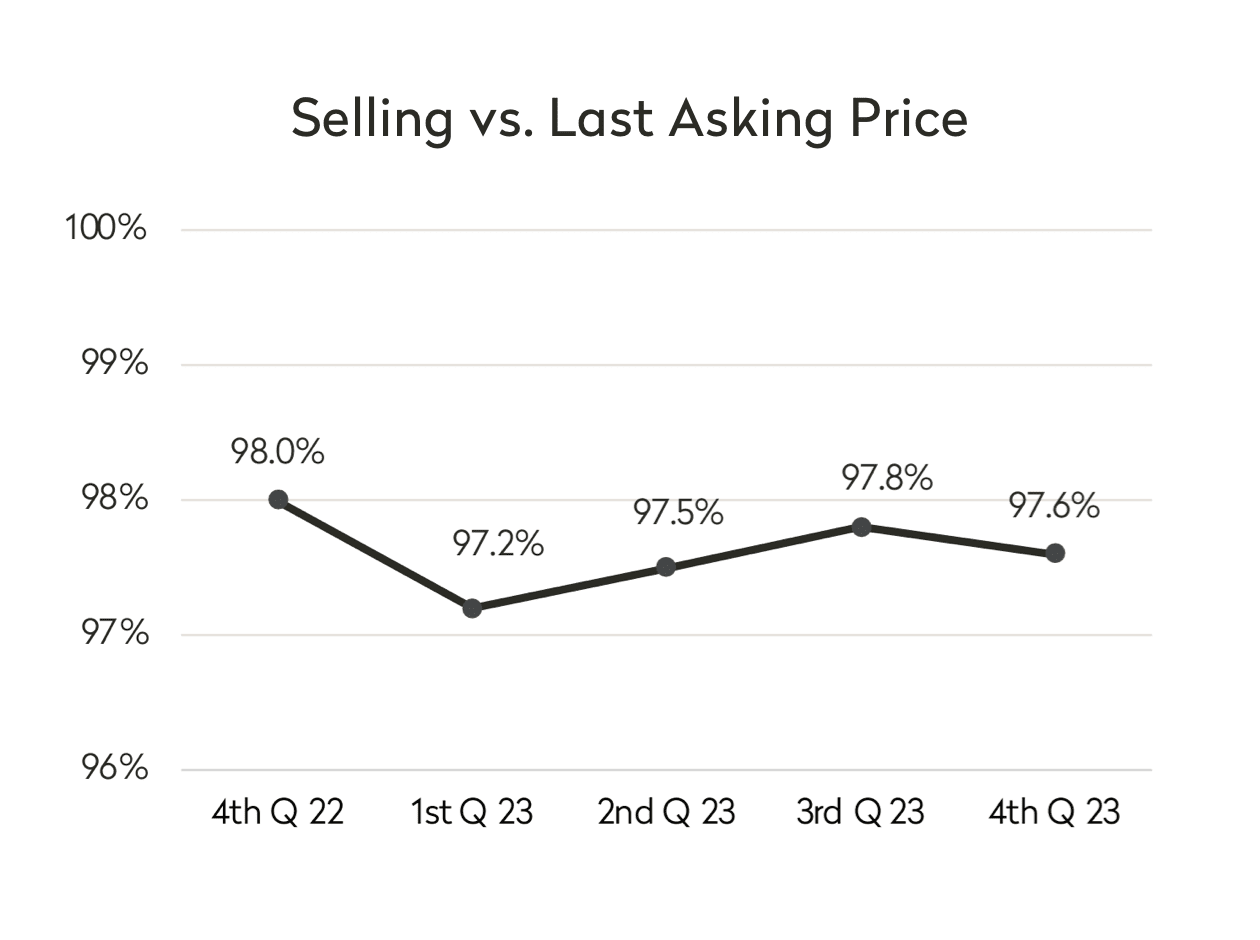

In resale, we saw more negotiability from sellers who achieved on average 97.6% of their last asking prices compared to 98.0% a year ago, no doubt motivated by increased time on market which rose 17% rise year-over-year.

As you review, you will find that as usual I have contextualized and supplemented my analysis below by drawing from Brown Harris Stevens’ Weekly Contracts Signed and January Inventory Reports as well as data on signed contracts for the Upper Luxury segment of the market ($4M+) from the Olshan Report which I closely monitor. It is my hope that you will find this assembly of data points and ensuing analyses useful as you weigh your needs, be they immediate or just for information.

Should you wish to receive any of the reports here referenced in their entirety, would like any further detail on the information here enclosed or have any needs or questions for which I can be of service, please don’t hesitate to call.

With all my best wishes,

In New Development, the Downtown market (South of 34th Street) accounted for 55.2% of sales in Q4 2023 compared to 48.9% last year. The average sale price for New Development was $2,913,010 in Q4 2023, down about 18% from last year when it was $3,558,273 as fewer high-ticket apartments traded. The average price per square foot by comparison decreased about 7% to $1,992 from last year when it was $2,144.

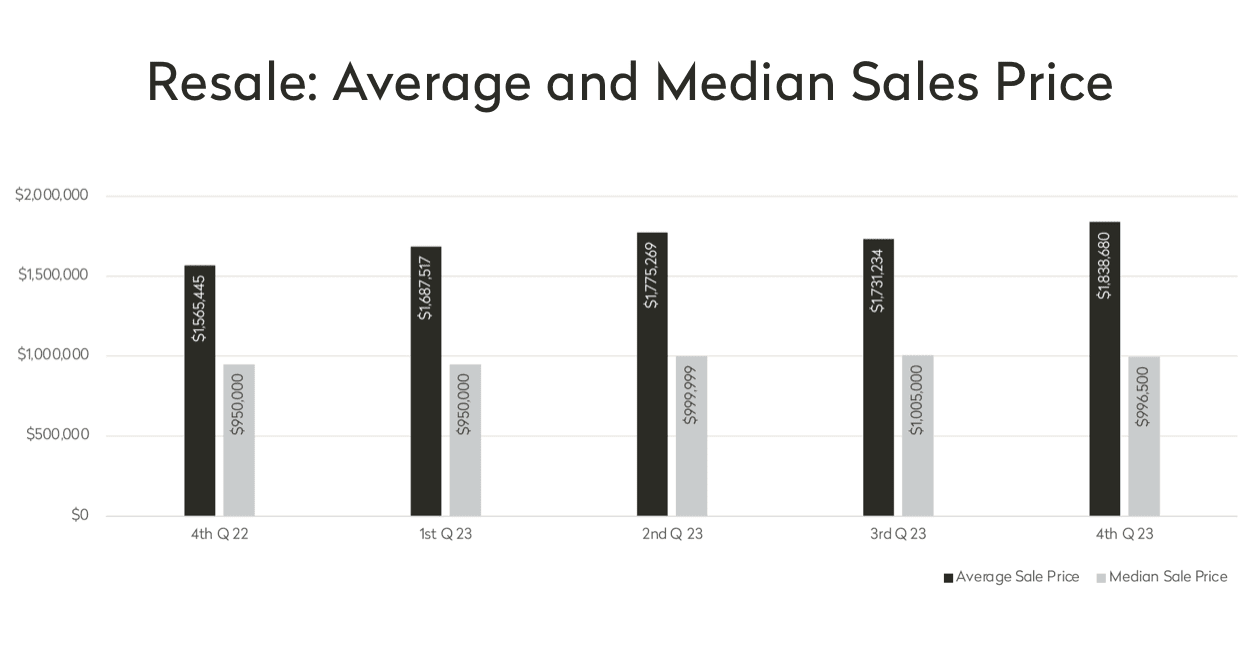

The average price of resale apartments came in unusually high due to four condo trades over $65M that brought the average price up 17% to $1,838,680 from $1,565,445 last year. We see the impacts of those large trades in the average price of 3+ bedroom condos which reported an average sales price 71% higher than last year: $8,511,938 in Q4 2023 compared to $4,968,300 in Q4 2022. By comparison, 3+ bedroom co-ops had an average sales price of $3,245,204 compared to $3,180,555 a year ago, representing a 2% increase.

As referenced above, time on market was up significantly to 116 days from 99 days a year ago, representing a 17% increase reflecting the sluggishness we saw in activity throughout the market as 2023 drew to a close.

With regards to where deal activity is in the immediate, despite some brutal weather over the last week, contract signings are up 8% from a year ago. Resale contract signings are notably up about 17% for a total of 97 contracts compared to the same week last year when there were 83 contracts. The largest gains were for properties priced between $2M - $3M which saw a 50% rise year-over-year.

According to year-end data from the Olshan Report which covers activity in the Upper Luxury segment of the market ($4M+), there were 1,198 contracts signed in 2023 which represents an 8% decline relative to 2022 when there were 1,304. As we saw in the greater marketplace, property in the Upper Luxury segment also took longer to trade in 2023 with an average of 615 days on market compared to 545 days in 2022, though it should be noted that this figure is slightly skewed by high-end new development condos which are typically absorbed more slowly.

The Trophy market ($10M+) had a strong year with 240 contracts signed, five more than last year when there were 235. As a result, 2023 ranked the third best year in the last decade for trades of Trophy property.

Looking at our current trajectory, so far in January we’ve seen 51 contracts signed on property asking $4M and up compared to 56 contracts a year ago.

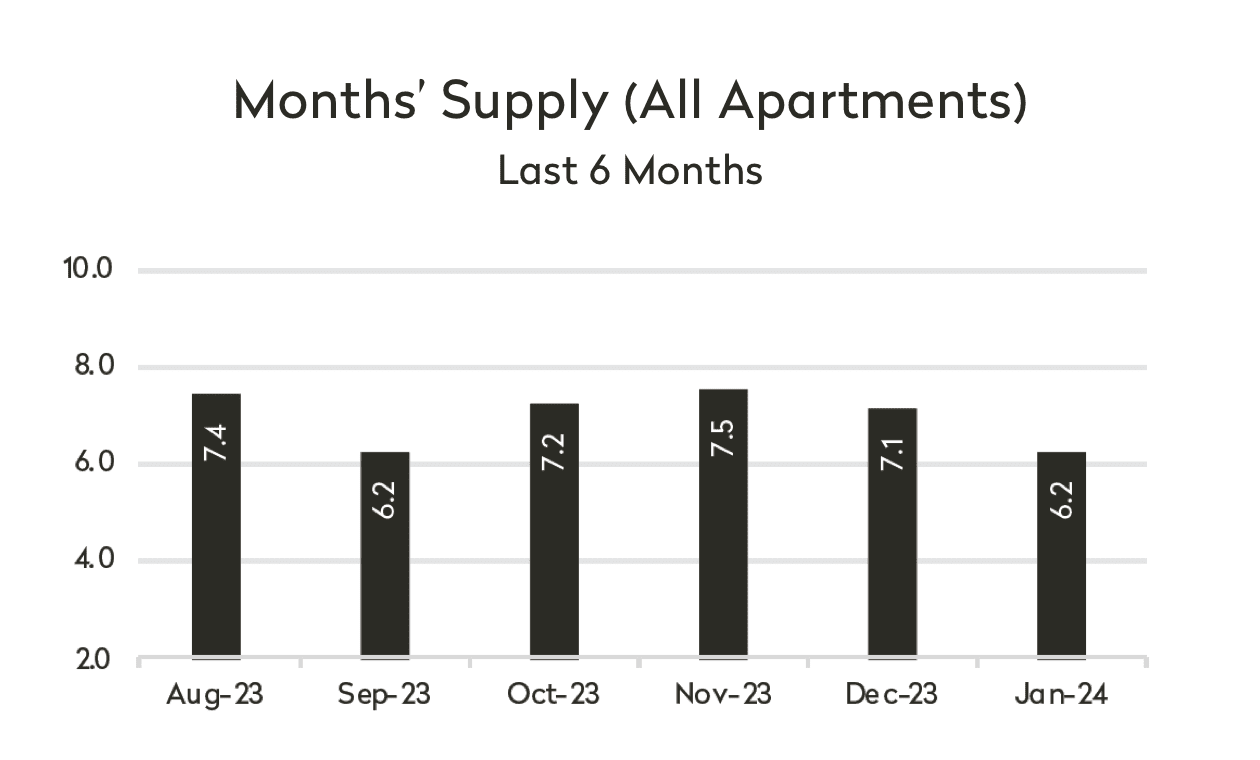

Inventory is one of the best indicators for the health of the market. Brown Harris Stevens’ January Inventory Report shows a 13% decline in supply rate to 6.2 months. Historically, a healthy supply rate is between 6-7 months.

While the slowdown in deal activity toward the end of the year saw listings accumulating on the market between September and November 2023, the supply rate began to decline in December when it was 7.1 months. It isn’t unusual for us to see this kind of pullback this time of year as there are sellers who take their homes off the market to wait for activity to kick back in.

A few highlights for you:

- On the whole, co-ops have a lean supply rate of 5.3 months compared to a supply rate of 7.4 months for condos.

- All neighborhoods posted a decline in supply, but the West Side is again the lowest at 4.8 months.

- The most oversupplied neighborhood was again Midtown West at 9.3 months.

The overall sentiment in the market is one of optimism as the market appears to be building momentum.

As previously referenced, a healthy relationship between supply and demand has kept prices stable in Manhattan in spite of slowed deal activity following the rise in interest rates which peaked in October 2023. As the cost of financing comes down further, buyers who have been delaying their searches are now re-entering the market with renewed enthusiasm.

Many buyers who couldn't pull the trigger at 8% are feeling greater comfort as mortgage rates trend lower. Prices aren't yet rising, and so these buyers are taking advantage of low levels of competition to lock in great deals while others drag their feet.

For that reason, if you are in fact considering a purchase the window of opportunity is open right now. The pundits say we may see rates go below 6% by the end of 2024. As the cost of financing drops, more and more buyers will be back in the market, narrowing any room for negotiation that exists at present. The savvy will secure the apartment they want at a great price now and refinance later when rates improve.

To those planning on selling, the time is right to start putting gears into motion and prepare to go to market. Not only is the Spring market just around the corner, there have been cash-buyers waiting in the wings for quality property and lower interest rates for months now. As new listings come to market and interest rates continue to decline, as noted above we're going to see a rise in activity as pent-up demand begins to give way.

In 2023, we saw a market much tamer than it was post-pandemic, but that's not surprising in the slightest given the sudden, sharp increase in the cost of financing, runaway inflation and the greater economic and geopolitical landscape. Considering all that's colored our lives over the last year, the market actually fared pretty well -- especially the Upper Luxury segment ($4M+).

While activity has been quiet for the first few weeks of January, I am seeing more and more buyers return to market: offers are going out and deals are getting done. With rates falling, the momentum now building is well indicative of renewed vitality to come. The coming weeks will be crucial as we gain a grip on the pulse of the market, but there are excellent opportunities for those prepared to capitalize on them.

I so hope the above feedback has been useful to you, and please don’t hesitate to get in touch with questions or requests for copies of any of the reports referenced in this analysis. As you consider your needs, be they immediate or for continued information, I hope that you will continue to think of me as your expert and that you won’t hesitate to reach out to me with any real estate needs that you may have.

Warmly,